Two brisk months on Wall Street was followed by a recent dip in the stock market as investors saw signs that perhaps the economy was not as strong as previously thought—given the more than 30 percent climb during the two months following March.

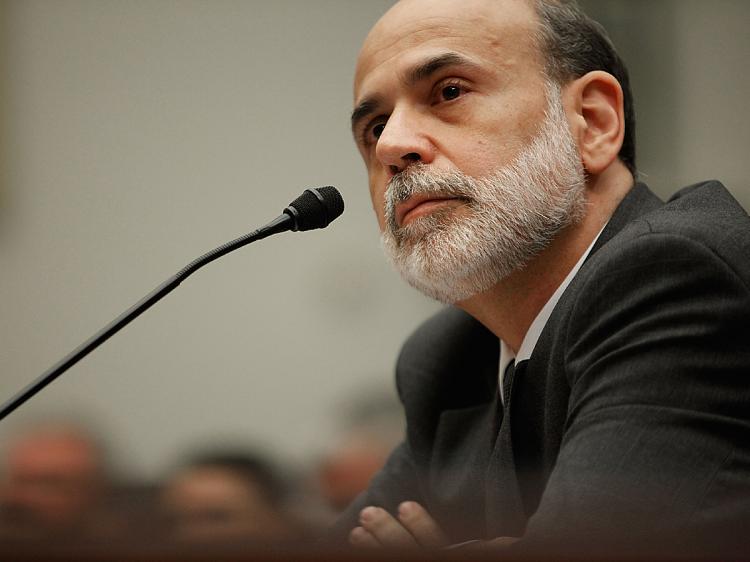

The latest report by the Federal Open Market Committee—the brains behind the nation’s economic decision makers—essentially repeated what it said in April, that the U.S. economic recession might be thawing.

“Conditions in financial markets have generally improved in recent months,” the Committee concluded in its report. “Household spending has shown further signs of stabilizing but remains constrained by ongoing job losses, lower housing wealth, and tight credit.”

Those are the same rhetoric that we’ve heard before. Reassuring, yes, but it’s far from language that inspires confidence in the market.

The Committee said that interest rates must remain low—the funds rate is currently at between 0 and 0.25 percent—to promote economic growth. Again, it was in line with the expectations of economists.

Inflation or Deflation?

The Fed has long grappled with risk of deflation, and it was interesting to note that the Committee report failed to mention once the dreaded “d” word. On one hand, deflation is kryptonite for a nation under recession, as it could give rise to another dreaded “d” word—depression.

Deflation means a period of falling prices and wages, leading consumers to put off purchases in hopes of further price declines. Deflation plagued the Japanese economy during much of the 1990s.

On the other hands, some economists say that as soon as we can stop worrying about deflation, we must face the challenge of inflation, or a weakening of the currency, driving up product prices.

The amount of debt the United States government has taken on to fund the stimulus package, TARP, and a myriad of other spending programs will surely devalue the U.S. dollar in the long run.

“For now it looks like [the Fed is] just going to wait and see how things play out and then react,” Greg Feirman, CEO of Top Gun Financial Planning, wrote in his blog. “The risk, in my opinion, is that inflation begins to take off and once it does it’s too late to get it back under control. In fact, that is my forecast.”

A Slow Climb

“We are gradually moving towards what should become a period of slow growth.” Charles Rotblut of Zacks Investment Research said in a note.

Others echo that same sentiment, predicting that any recovery after this recession will be a slow one filled with treacherous landmines (commercial mortgages anyone?).

Warren Buffett, on a CNBC interview on Wednesday, said that “green shoots” are not yet visible in the barren land that is the U.S. economy.