Rio released a statement from its London headquarters, late Wednesday saying the company was pursuing “a range of options for maximizing shareholder value” and that a further announcement was pending.

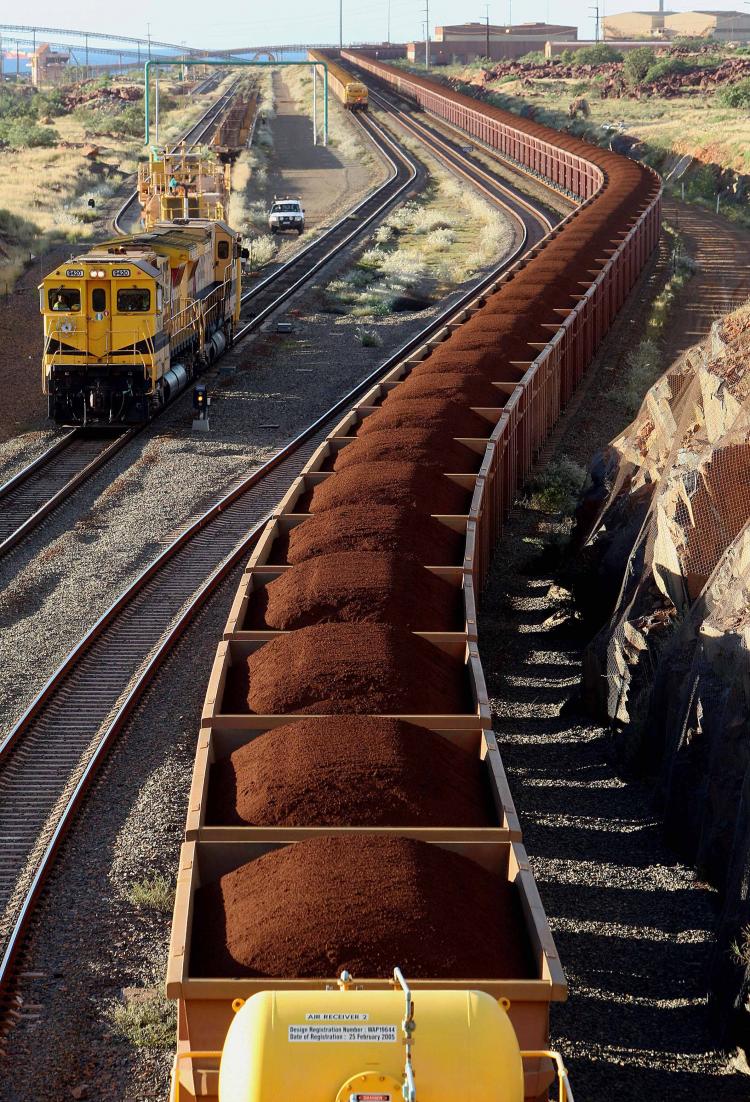

It is understood that Rio had informed Chinalco it would not proceed with the deal, which was struck at the nadir of the downturn earlier in the year. That deal would have seen the Chinese company pay $19.5 billion in convertible bonds and in return gain two seats on the Rio board and an increased stake in the company - from 9 per cent to 18 percent. The deal also allowed for stakes between 15 and 50 per cent in Rio Tinto’s Pilbara iron ore and Weipa bauxite operations in Australia.

William McNamara, mining correspondent for The Financial Times, said the deal had been pitched at “about the bleakest time in living memory,” with Rio $40 billion in debt and no obvious way out.

“We think the board went with Chinalco because they offered the most money,” he told Australian national radio, ABC.

However, with the improvement in the economy and increasing shareholder concern about the state-owned Chinese company, Mr McNamara said the deal “was now dead.”

A source close to Chinalco confirmed that the deal was over, saying, “Rio Tinto has informally notified Chinalco over the past day or so, it will be withdrawing its recommendation and would be replacing it with a $15 billion rights [stock] cissue,” Fairfax media reported.

The rights issue is likely to relieve Rio of its immediate debt concerns and pave the way for an arrangement with another mining competitor, BHP Billiton, which is likely to include the prized Pilbara iron ore assets.

BHP Billiton pulled out of a $66 billion bid for Rio Tinto late last year despite having spent 18 months and over $400 million on the possible deal. The company said at the time it was no longer in the shareholders’ interest.

The deal’s collapse is likely to be met with silent relief from the Australian government, as the Australian Foreign Investment Review Board (FIRB) was due to bring down its decision June 15, as to whether the state-owned Chinalco could be considered independent, as claimed by the company.

Statements made in an Australian Senate economics committee on June 3 indicate that Australian Treasury does not see a government-owned entity as independent of the foreign government.

“The question that we will have is, what is the governance of the entity; how does it operate; and can we see that it is operating independently, without direct and continuing government control?” Patrick Colmer, general manager of the Australian Treasury’s foreign investment division told the committee.

Rio’s decision has saved the Australian government from a difficult political decision, but the company still has to see its way out of the deal.

The original Rio Chinalco investment contract requires Rio to pay Chinalco $195 million should it renege on the deal.

Mr. MacNamara said Chinalco would be “the one smarting the most about the deal”.

“It was really a deal of a lifetime for them [Chinalco] and it has now passed them by. You don’t get a chance to get your hands on the assets of the quality that Rio was offering more than once in a lifetime if you are a company like Chinalco,” he said.

Chinese aspirations for cross-border mergers and acquisitions had not been as successful as they had hoped for in 2008 and 2009.

While $22.3 billion had been completed, $2.9 billion had been withdrawn, and $21.6 billion, including the Rio deal, was still pending, Forbes reported.

“Many Western governments are concerned about the Chinese government owning sensitive assets,” he said.

“Many Chinese companies are state owned or have state-owned banks backing them up,” said Jan Randolph, head of sovereign risk at IHS Global Insight.

Friends Read Free