Commentary

Buried in the newly adopted “21st Century Peace Through Strength Act” (H.R.8038) that was recently enacted, is a provision that authorizes the president to seize and transfer certain Russian sovereign assets to fund Ukrainian war compensation or reconstruction. While only $4–5 billion of those assets are subject to U.S. jurisdiction, another $190 billion is held in Europe, primarily within Belgium, according to the bill.

In addition, the Biden administration is also reportedly drafting rules that would impinge Chinese banks’ ability to conduct dollar-based trade. The rules would sanction China for selling what the Biden administration claims are “dual use” (i.e., civilian and military) technology. Beijing had already complied with the Biden administration’s requests to send military aid to Ukraine.

Supporting an Ally Shouldn’t Be a Suicide Pact

Writing of the rule of law and constitutional rights, authorities from Thomas Jefferson to the U.S. Supreme Court have said, in effect and literally, that “the Constitution is not a suicide pact.” By that, they meant to say that American leaders should not be so burdened by the rule of law in times of crisis that they should not act pragmatically to defend the nation from destruction.But as the U.S. Constitution is not a suicide pact, neither should be an alliance. Yet the Biden administration seems dead set on committing “suicide” for the dollar as the world’s reserve currency.

What Is Our Interest?

Russia’s invasion of Crimea and, later, the rest of Ukraine, was a grievous assault on that nation that we can all abhor. But Ukraine was not ever such a vital—or even peripheral—interest of the United States that we should endanger the dollar as the world’s reserve currency. Recall that Ukraine had been a vassal state to Russia under its prior president, Viktor Yanukovych, a puppet of Russian President Vladimir Putin, until the Euromaidan Revolution in 2014. Recall, too, that when Russia commenced its invasion in February 2022, the United States offered to evacuate Ukrainian President Volodymyr Zelenskyy. We had been willing to basically surrender Ukraine to Russian control.So Why Risk Dollar Dominance Over Ukraine?

Secretary of State Antony Blinken has asserted we should forcefully counter Russia’s aggression because it violated “the postwar, liberal, rules-based order.” He also fears that acquiescing to it would “return us to spheres of influence,” whereby powerful states influence the policies of less powerful neighbors. But those reasons seem nebulous and naive, respectively. The post–Cold War order is neither “liberal” nor “rules based.” “Rules” have been abridged or abrogated regularly over the last 30 years because neither the United States nor Russia (once the Soviet Union) can fully constrain their client states, as they did during the Cold War. And as to “spheres of influence”—the reasons we nearly went to nuclear war when the Soviet Union put nuclear warheads in Cuba have never really gone away.The Dollar Is a Vital Interest

Unlike Ukraine, the preeminence of the U.S. dollar as the world’s reserve currency certainly is a vital American interest. It is even the vital interest of the world; it is a safe haven in a liberal, democratic, republic that observes the rule of law and with regulated and transparent markets.

Former French President Valéry Giscard d’Estaing once called the dollar’s status as the world’s reserve currency our “exorbitant privilege”—one that he envied (and resented). It allows the United States to float our debt at rates that are much lower than the rest of the world. It boosts the value of our financial markets because the U.S. dollar is seen as a global “safe haven,” particularly in times of crisis. Dollars pour into our markets from foreign investors. And the dollar will be accepted as a unit of exchange in virtually every economy in the world.

For all these reasons, America’s leaders should hold the preeminence of the U.S. dollar sacrosanct. Instead, they have exercised it with a stunning and irresponsible hubris that invites a backlash.

And a backlash has ensued.

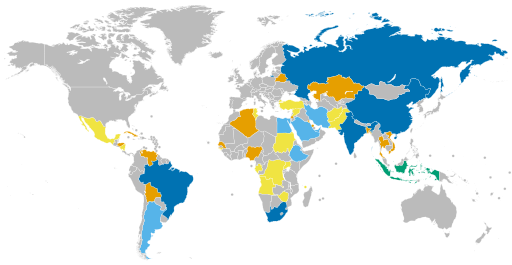

The BRICS+, the informal organization started by Brazil, Russia, India, China, and South Africa in the aftermath of the financial crisis of 2008–09, and having now been joined by others in the global south, have long disparaged the preeminence of the U.S. dollar. Increasingly, they have been settling transactions among themselves in their own currencies to avoid using the greenback.

The Center for Strategic and International Studies warned in 2022:

“Countries such as the United States that employ financial sanctions should prepare for the development of alternative financial arrangements in China and possibly elsewhere.”

China has introduced a digital renminbi, a central bank digital currency, that avoids the need for SWIFT, the means by which funds are transferred from one country to another. In the past, SWIFT one of the principal means of enforcing U.S. dollar sanctions. China is also laying in heavy reserves of gold and oil as alternative stores of value to the dollar.

We will likely regret ever having used the U.S. dollar as a weapon in a proxy war with Russia over Ukraine. It will harm and undermine our economy in years to come. For many countries, our seizure of Russian assets and our sanctions on China’s banks will be the proverbial “last straw.” And we will hear the last gasp of the U.S. dollar as the world’s reserve currency.